HSAs, FSAs and Diabetes: What You Need to Know

When you are living with diabetes, it often means there are regular medical costs. This could include anything from insulin and testing supplies to doctor visits and technology like continuous glucose monitors (CGMs). The good news is that tools like Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) can help you manage these expenses. But what’s the difference between them? And how does your deductible fit into the picture?

Let’s break it down.

What Is an HSA?

- A Health Savings Account (HSA) is a special type of savings account that lets you set aside pre-tax money to pay for qualified medical expenses. You’re eligible for an HSA only if you’re enrolled in a High Deductible Health Plan (HDHP), which has higher deductibles and lower monthly premiums than traditional insurance. The IRS sets the deductible and out-of-pocket maximums for these plans each year.

- You cannot open an HSA if you’re enrolled in Medicare. Veterans can use an HSA along with VA benefits, as long as the care is related to a service-connected disability.

- HSAs offer strong tax advantages. Contributions are tax-free, withdrawals for qualified medical expenses are also tax-free, and people age 55 and older can make additional “catch-up” contributions.

- HSAs are flexible and can grow over time. Money rolls over from year to year, the account stays with you even if you change jobs or insurance, and some accounts allow you to invest your balance like a retirement account.

- Funds can be used for a wide range of healthcare costs, including deductibles, copayments, coinsurance, services not covered by insurance, diagnosis and treatment, prevention, long-term care services, transportation for medical care, and expenses for yourself, your spouse, or your dependents.

- HSAs can be especially valuable if you live with diabetes, since they can cover insulin products, delivery devices like pumps or pens, and supplies or routine care needs such as lab work and durable medical equipment.

Why an HSA Can Help with Managing Diabetes

If you’re living with diabetes, you likely have regular, ongoing healthcare costs such as insulin, pump supplies, or routine lab work. An HSA can make these expenses easier to manage by helping you plan ahead and stretch your dollars further.

- Tax-free withdrawals: You can use HSA funds for qualified medical expenses for yourself, your spouse, or your dependents without paying taxes.

- Qualified expenses include: diagnosis, treatment, prevention, long-term care services, and even transportation for medical appointments.

- Diabetes-specific coverage: HSAs cover essential supplies such as all types of insulin, insulin delivery devices, and other routine diabetes care expenses.

By setting aside pre-tax dollars, you’re not only saving on everyday care but also building a financial cushion for future health needs.

What Is an FSA?

A Flexible Spending Account (FSA) is another way to set aside money for health costs:

- FSAs are set up through your employer.

- Like HSAs, the money you put into a Flexible Spending Account (FSA) is tax-free, but the two accounts work very differently. FSA contributions come directly from your paycheck and are set aside for qualifying medical or dependent care expenses. Unlike an HSA, the money in an FSA isn’t invested—it’s meant to cover short-term, expected costs. FSAs also have a “use it or lose it” rule. For 2025, you can roll over up to $660 in unused funds, though this limit may change from year to year.

- The biggest difference between FSAs and HSAs is that most FSAs follow a “use it or lose it” rule. If you don’t spend the money in your account by the end of the year (or within a short grace period), the remaining balance is forfeited. Because of this, it’s always a good idea to check with your employer to understand which expenses can be reimbursed through your FSA. Typically, a Medical FSA can cover costs like copayments, deductibles, prescriptions, certain therapy services, and dental or vision care. A Dependent Care FSA is different—it helps pay for expenses such as childcare, preschool, day camp, or in-home care. For 2025, the maximum contribution limit is $3,300 for a Healthcare FSA and $5,000 for a Dependent Care FSA (for joint filers).

- You don’t need a high-deductible plan to qualify for a Health Care FSA. These accounts are completely separate from your insurance coverage and are designed to help you set aside money for medical expenses you expect to have in the upcoming year.

Why it’s helpful for managing diabetes: An FSA is great if you know you’ll have predictable costs in the next year, like prescriptions, CGM sensors, or doctor visits.

What Is a Deductible?

Your deductible is the amount you pay out of pocket before your health insurance starts covering its share of the costs. When selecting a health plan, you’ll typically choose between two trade-offs:

- Plans with lower deductibles and lower out-of-pocket costs usually come with higher monthly premiums.

- Plans with higher deductibles and higher out-of-pocket costs usually offer lower monthly premiums.

In other words, you’re deciding whether to pay more each month to reduce what you owe when you need care or pay less each month but cover more upfront if you do need medical services.

Example:

- If your deductible is $2,000, you must pay $2,000 worth of medical bills before your insurance starts paying (except for certain preventive care, which is usually covered right away).

- After your deductible is met, insurance covers a larger share, and you may only owe copays or a percentage (called coinsurance).

What this means for diabetes: If your deductible is high, your first few months of insulin, doctor visits, and supplies may cost a lot until you meet that deductible. However, using an HSA or FSA can help offset these upfront costs!

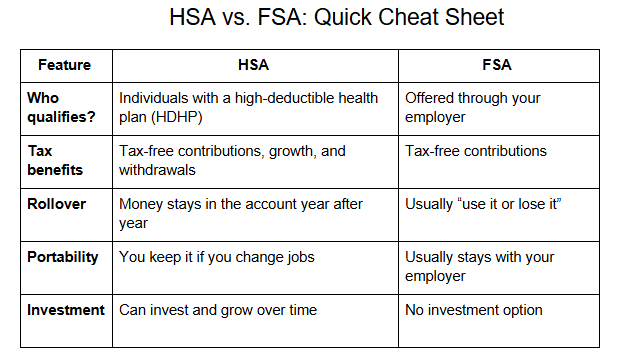

Here’s a helpful chart to help you visualize the benefits and differences between HSAs and FSAs.

Tips for Managing Diabetes Costs

- Plan ahead. Estimate your yearly diabetes expenses so you know how much to set aside in an HSA or FSA.

- Use tax-free dollars first. Pay for insulin, test strips, and supplies through these accounts to save money.

- Check your plan. Not all expenses count as qualified medical expenses. Verify what’s covered.

- Track your deductible: Keep an eye on how much you’ve paid toward your deductible, so you don’t get caught off guard.

Breaking it Down

Understanding HSAs, FSAs, and your deductible can make a big difference in managing diabetes-related costs. Be sure to review your health plan each year, as your needs—and your family’s needs—may change, making another option a better fit.

Author: Janet Dominowski, MS, RDN, CDCES | CCS Health

This site is for educational purposes only. Talk to your doctor or healthcare provider before making any decisions about your health.